SG Wealth Builder

Make money. Build Wealth. Preserve Wealth

Year: 2014

How to start your investment journey

Hi SG Wealth Builder,

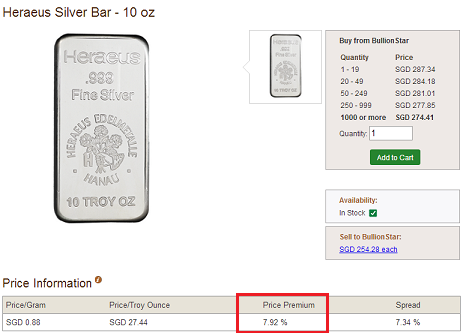

BullionStar explained the difference between spot price and price premium

Below is an article from BullionStar, a bullion dealer based in Singapore where you can buy and store gold and silver at competitive prices. BullionStar was established in 2012 after Singapore government exempted investment grade precious metals from the goods and services tax (GST). Just like BullionStar, one of the goals of SG Wealth Builder is to educate Singaporeans on the merits of owning gold and silver bullion as a means of wealth preservation.

Precious metals and bullion products in physical form often have a higher price than the spot-price. The spot-price is the price for which someone can buy certificates or futures on the commodity exchange. It is however mathematically impossible, based on the paper market volume traded, for these so called paper metal products to be fully backed by physical precious metals.

Premium for Precious Metals

There are two components in the price premium for physical gold and silver.

How to invest in gold in Singapore

Basically, with effect from 1 Oct 2012, the importation and supply of IPM in Singapore are exempt from GST. The supply of IPM which is exported continues to be zero-rated. However, only precious metals in the form of a bar, ingot, wafer and coin which meet certain criteria can qualify as IPM.

To provide certainty, precious metal coins that qualify as IPM are prescribed in the GST Act. Precious metals which do not meet the criteria cannot qualify as IPM and the supply of non-IPM continues to be taxable. Examples of non-IPM are jewellery, scrap precious metals, numismatic coins and precious metals which are refined by refiners who are not on the “Good Delivery” list of the London Bullion Market Association or the London Platinum and Palladium Market.

Ruthless paycut

Since last year, there were lingering rumors that HR was hatching some plans to adjust our variable specialist allowances but we thought that the most drastic move that they would resort would be to incorporate the variable component into our basic pay. We never expect in our wildest dream that they would remove all our allowances. For many of us, the amount is a huge amount and make up at least 30% of our pay. So obviously we were very unhappy. The only consolation news was that the organization would remove the allowances in three years phases, so that affected staff would have time to adjust their personal finances.

This variable adjustable component was indicated in our salary contracts but the HR director insisted that the term “variable” means that the amount can be zero as well, subjected to individual performance and market condition. When he made that kind of statement, all my trust in the organization immediately flushed down the drain.

Achieving financial freedom in Singapore

Sorry to message you out of the blue (you may consider to publish my email but kindly oblique my name and email). I am 37 as of this year and I am a civil servant (which means I cannot do part time jobs or start a business) who have difficulty achieving financial stability.

The only good thing now is that I am not in debt (finally), apart from the $10,000 medical bills incurred recently (I have a exclusion for heart) which I am paying $300 per month interest free.

I tried reading all your posts from day 1 and more or less understand your objectives and purpose of the blog.

I am a person whom is very keen on being financially free in time to come and hope I can do it via investment. (one of the ways if i choose not to leave this current employment).

However, being an engineering student from polytechnic, I find it hard to kick-start my investment journey and often feel lost. Are you able to recommend me some books or what kind of topic I can look for before I can understand how this whole investment thing come about and how can I start doing it as time is definitely not on my side as I am approaching 40?

Secret formula to win the property game

During that busy period, I read the e-book “No B.S. Guide to Property Investment – Dirty Truths and Profitable Secrets to Building Wealth through Properties” for the second time during the MRT rides to work. Property Soul gave it to me and I had written a book review for her in my previous article.The reason why I re-read the book was because I believe that to be a successful wealth builder in property investments, you must acquire the right knowledge.

Property Investment Insights

According to Moneysense, if you applied for HDB Concessionary Loan to repay the loan for your properties in Singapore, there will be a cap to the amount of CPF savings you can use. This limit is called the CPF Valuation Limit and the amount is the lower of the purchase price or valuation at the time of purchase. For example: if you bought the property for $300,000 and its valuation is $330,000, the Valuation Limit will be $300,000.

My financial journey

$250.That was the total amount of savings in my bank accounts when I just started working in 2005. On looking back, it was really a “touch and go” financial situation for me. I had depleted all my life savings because I had stopped receiving allowances from my parents when I was studying for a full time degree at NUS.

I did not want to burden my parents because my late father’s business was not doing well and my mom was a full time housewife. Our household income wasn’t that ideal back then partially also due to my father’s stroke condition.

So I had to supplement my savings with part-time jobs like giving tuition during the school holidays.So if you ask me what is it like to be poor, I can fully empathize. After all, I have went through this dark journey before and I am thankful that I had emerged from that challenging period to become a stronger person.

For those who are born rich, social mobility may be a strange word to them, however I do not blame them because they do not know what is it like to worry for money. For the rich and wealthy, Singapore is like a playground where they can indulge in expensive toys like fast cars, yachts and lavish landed properties.

Guest Posting: 5 Forex trading metrics you’re probably not tracking but should be

1) Hold duration

Do you hold your long positions for a few days or are you comfortable with intraday trades? How long you hold a trade can reveal your appetite for risk. Short-term traders will exit at the first sign of a dip while traders who keep their position for more than a day jump in with a fairly good idea of what to expect from a pair. Then, there are position traders who may hold on to a currency for months or even years.

2) Hold duration part 2 – Hold durations of wins vs.

What is Return on Invested Capital?

This article was written by Willie Keng and was first published in Value Invest Asia on 17 July 2014.

In a previous article, Stanley explained the Return on Equity (ROE). While the ROE focuses on the equity component of a company’s capital investments, the Return on Invested Capital (ROIC) measures return earned on investments funded by equity and debt.

It shows how much profit a company generates for every dollar of investments it makes in the business. ROIC is expressed as a percentage and shown in the formula below:

We can calculate the ROIC using an example from Banyan Tree Holdings’ (SGX: B58) financial statement:

| Annual Report (SGD ’000) | Fiscal Year 2012 |

| Property, Plant and Equipment | 729,558 |

| Current Assets | 349,304 |

| Current Liabilities | 231,875 |

| Cash | 120,824 |

| Invested Capital | 726,163 |

| Fiscal Year 2013 | |

| Operating Income | 51,641 |

| Tax Rate | 42%* |

| After-Tax Operating Income | 29,951 |

| Return on Invested Capital (ROIC) | 4.1% |

*The high tax rate was due to the different geographic segments the company operates in

Based on the calculations above, we note that Banyan Tree generated an ROIC of 4.1% for FY2013.

The REIT Association of Singapore

As a financial blogger, I received a lot of media invitations from various financial institutes, banks and companies. Most of the times, I declined the invitations because of work commitments. Recently, I was invited to attend the official launch of REIT Association of Singapore (REITAS) on 17 November 2014. I would like to attend this event to find out more about the role of this association but as usual, I am unable to attend because of work schedule conflicts.

It seems to me that the association consists of big players from Keppel, Mapletree, Capitaland, Frasers and ARA Asset Management and their key thrusts are to engage Monetary Authority of Singapore on regulatory issues and to promote the understanding of REITs.

This is a good development because as the industry matures, the association can help to look into areas that can be improved, especially on the structure of REITs. For example, in my previous article on REITs, I don’t understand why is there a need for external manager for REITs. Such requirement only incur more costs which would be eventually passed down to investors.

Most retail investors claim they know about the REIT they invested in but I suspected they are none the wiser than me on the business model.

SPH in panic mode and invested $30 million in CoSine Holdings Pte Ltd

In October 2014, when SPH announced a decline of 6.8% in advertising revenues from newspaper and magazine, it was a sign of things to come. After all, the media giant derived the bulk of its income from advertisements and with the proliferation of cheaper and more effective online marketing platforms, they are beginning to feel the heat. In fact, social media and online blogs like SG Wealth Builder are giving SPH a run for their money. This is because with online blogs and websites, clients can market their products and services to the international market. In today’s context, the motivation for companies to advertise in Singapore newspapers and magazines is becoming less appealing due to the limited market reach.

Indeed, SPH might have seen this coming many years ago when it invested $18 million in ShareInvestor Holding Pte Ltd. Given the high internet penetration rate in Singapore, it made sense for SPH to make its foray into the digital media and establish revenue from its online media arm. Other notable online investments by SPH included Sgcarmart (bought for $60 million in 2013) and Hardwarezone ($7.1 million in 2006). Apart from these mega acquisitions, SPH had been relatively slow in acquiring new online start-ups.

BullionStar: The first company in Singapore to pay salaries in Gold & Silver!

Unemployment and entrepreneurship in Singapore

Thank you.

I received the above queries from one of my readers and it coincides with an article I read in Yahoo Singapore recently about underemployment rate of local graduates. To me, this is a timely topic for me to dwell on because in a few more years, I will hit the forties bracket. Sooner or later, I may face the predicament or prospect of being retrenched from my job, so I think it is worthwhile to reflect and examine this issue now before it really impact me big time later on in my life.

To put things into perspective, the Singapore employment landscape has changed over the years. In the 80s and 90s, if you had tertiary qualifications, you would unlikely be fearful of the word “downsize” in your company because back then, there were not so many graduates with 10 – 15 years of working experiences in the job market. But times had changed. Nowadays, the market is glutted with graduates from local and overseas, private and public universities.

SGX launches stock and company information portal StockFacts for investors

- A comprehensive research database, covering stock fundamentals for all SGX-listed companies

- Customised search, giving investors flexibility to filter stocks across 20 screening criteria

- New proprietary tools, including S&P Capital IQ Alpha Factor Composites, which ranks stocks based on eight investment style classifications

- Ability to chart a company’s financials for the last five years

- Downloading and printing of company snapshots for easy analysing

It can be accessed through SGX’s corporate website at www.sgx.com/stockfacts. The url for the press release is http://www.sgx.com/wps/wcm/connect/sgx_en/home/higlights/news_releases/sgx-launches-stock-and-company-information-portal-stockfacts-for-investors.

A little act of caring creates a seamless ripple

He recounted that when he was young, his family was poor. On his seventh birthday, he and his mother went to a cake shop but had no money to buy a birthday cake. He was disappointed and refused to leave the shop. Then, a middle-age man who was standing behind them, saw the awkward situation and bought a birthday cake. He then offered the cake to him and wished him a happy birthday.

The mother was so grateful to the man and requested him to note down his address so that one day she could return the money to him.

Property Education Seminar: Smart Landlords Vs Smart Tenants

Grow Your Best and Most Important Asset – Personal Financial Investment Seminar

Indeed, my blog has not achieved the kind of success enjoyed by Mr Tan, but I like to view this as a project still very much “work-in-progress”.

Haw Par Corp an ultra value stock?

Tactical Job Hunting

Email

Have a dedicated email account for the job hunt, this way you can channel all your information, interview details, contacts, job portal alerts here.

On a more psychological sense, it can help to channel your energy and motivation the moment you open this email account, tell yourself to focus on the job search, not distracted by emails from Facebook, Twitter and other social media alerts.

Of course, please have a professional email address, enough said.

Excel spreadsheet

Open an Excel Spreadsheet.The

Singapore Kilobar Gold Contract To Launch in October 2014

Why I would not encourage my mother to take up the Enhanced HDB Lease Buyback Scheme

On 03 Sep 2014, the government announced four enhancements to the HDB Lease Buyback Scheme (LBS) as follows:1) The scheme will be extended to 4-room HDB flats and to sweeten the deal, there will be a $10,000 cash bonus per household when the elderly participate in the scheme.

2) The income ceiling will be raised to $10,000 from $3,000 per month to allow elderly who are still working or still living with their family members to qualify for this scheme.

3) The requirements to top up their CPF Retirement Accounts with the LBS proceeds will be relaxed as reflected in Table 1 below.

Table 1: Change in CPF Top-Up Requirement* for Households with Two or More Owners

Owner’s Age | Current (Age-Adjusted MS) | New (0.5 x Age-Adjusted MS) |

CPF Draw-Down Age (now 63) to 69 | $155,000 | $77,500 |

70 to 79 | $145,000 | $72,500 |

80 or older | $135,000 | $67,500 |

By and large, the LBS is a good scheme that allows the elderly the additional option to monetize their property asset to fund their retirement needs.

OCBC Open Account

8 Things You Should Know About Your CPF Nomination

Below is an article published with permission from the CPF Board. Singaporeans should note the point that a Will does not cover the distribution of CPF savings after death. So please make your CPF nominations as soon as possible. You don’t want your loved ones to encounter complications over the distribution of your wealth after you are gone. What is the point of being rich but not able to transfer your wealth to your loved ones when you are not around?

A CPF nomination allows CPF members to specify who will receive their CPF savings, and how much each nominee should receive when they pass away. Here’s a list of FAQs to help you better understand it. Information on CPF nomination is also available at the CPF website.

Q1: What happens to my CPF monies if I pass away without making a CPF nomination?

Your entire savings in all your CPF accounts will be distributed by the Public Trustee to your family members according to the intestacy law or the Certificate of Inheritance (for Muslims). So, you need not worry about your CPF monies landing in the wrong hands even if you do not make a CPF nomination.

Read MoreCareer breaks

This is simply a flawed analysis and a one-size-fits-all kind of advice. Many successful corporate leaders and entrepreneurs have taken career breaks and became even more successful after those breaks.

I have a junior associate who quit last year to tour around the world (using her savings not parents money in case you are wondering) and now ready to return to work. 3-4 firms are competing for her. Some MNCs like people who are well exposed.

Also, getting out without a job and getting in again, it’s all about how one articulates his/her decision to quit. Another perspective is what the person has done during the out-of-job period. Be it charity, helping out family, traveling, or learning a new skills. If there’s something that helped build the person’s strengths, it will only make him/her even more attractive in searching for a new job – Anonymous Reader

The above comment was made by one of my readers in response to my previous article “Why You Should Not Quit Without a Job In Singapore”. His perspective was that taking a career break is good because it helps one to recharge and make a better comeback in their job journey.

While I don’t dispute that taking career breaks are good for us, but I think what he didn’t realize is that most Singaporeans quit without a job because of “escapism mentality” and not because they wanted to pursue other interests or higher priorities in life.

BullionStar: India’s June Gold Import Highest in 12 Months

Despite the fact the new Indian government, led by Narandra Modi since May, hasn’t lowered the import duties on both gold and silver, Indians keep on buying precious metals. Despite the fact we already knew this, there was less gold being smuggled into the country and more imported through official channels last June; 77 tonnes were gross imported, which is up 48 % from a month earlier, and up 75 % from June last year. This was accompanied by falling premiums.Gross export in June accounted for 4 tonnes, according to India’s customs department DGCIS. One of the import restrictions the Indian government implied on gold in 2013 was the 80/20 rule; of every amount of gold imported 20 % has to be re-exported. The gross amount exported in June falls short of the required 15.4 tonnes (20 % of 77 tonnes is 15.4 tonnes), meaning importers have some overdue obligations to be met in coming months. The other restriction on gold (and silver) is an import duty of 10 %, and the Indian government can obstruct consignments.

Plan for future?

The reason why Singaporeans are unhappy

As children, happiness was all about getting our desired toys or playing our favorite games. If we did not get what we want, we threw tantrums or cried. When we became working adults, being happy meant achieving our goals and dreams. If we did not meet our self expectations, we became unhappy, frustrated and indulged in the blame game.

As we matured and entered into our twilight years, happiness was about attaining a balanced state of mind. If we were unhealthy or sick-ridden, we could not have a peace of mind.

The above philosophy perhaps summed up what happiness represents in different phases of our lives. In recent years, there were a lot of articles on this topic and there were also much debate on how Singaporeans view the quality of their lives in the lion city.

This is a natural progression of our civic society and many Singaporeans have began to think beyond the pursuit of money.

Obviously, money is important and we should always respect money. But many of us begin to realize that life is not all about making more and more money. There are many things in life that money cannot buy – respect, love, kinship and friendship.

8 Things You Should Know When Using CPF for Property

Below is an article published with permission from the CPF Board. Singapore home owners should pay close attention to the policy on accrued interest for CPF monies.

Many members use CPF savings when buying a property. Before you decide on buying your dream home, we highly recommend reading “Things to look out for when buying a property using CPF” and watching “Buying a House” videos. Here’re 8 essentials you should be aware of. Please note that the information may be different if you are using CPF for multiple properties.

Q1. What CPF savings can I use to buy a property?

Only Ordinary Account (OA) savings can be used for property. You can use it to:

(i) Pay lumpsum/downpayment to HDB for the purchase of an HDB flat, or to a property developer or a seller for the purchase of a private property.

(ii) Repay the housing loan taken for the purchase of HDB flat or private property.

(iii) Pay legal fees, stamp duty, transfer fees and other related costs incurred in relation to the housing purchase.

(iv) Repay a housing loan taken for the purchase of land and/or for construction of a house on that land (for private property).