OCBC Blue Chip Investment Plan

You do not need to go through the hassle and open any securities trading account or Central Depository (Pte) Ltd securities account for your shares under this plan. All you need is an OCBC deposit account, OCBC CPF Investment Account or OCBC SRS account.

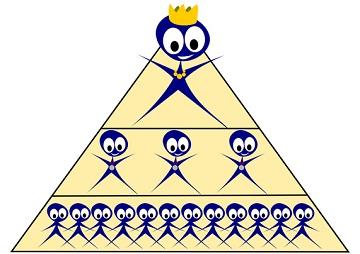

My view on this scheme is that OCBC has identified a gap in the market and that this scheme is actually meant to address this gap. According to SGX, retail investors account for only 89 per cent of the daily turnover for stocks with a market capitalisation of under S$200 million. But retail investors make up only a quarter of the daily turnover for blue chips, with the rest of the trading controlled by institutional investors. So clearly, most retail players’ participation rate has been low because blue chips’ entry price is relatively high compared to other counters. OCBC hopes that the new plan gives investors an option to buy smaller number of shares with their chosen monthly investment amount.

Always remember, caveat emptor (buyer beware)

Always remember, caveat emptor (buyer beware)