OCBC share price (SGX: O39) to rocket with record earnings?

My first article of the year will be on OCBC share price (SGX: O39). 2022 is considered by many investors to be a pivotal year as Singapore’s economy continues its path of recovery from the devastating pandemic. Many of us harbour fervent hopes that 2022 will herald the light at end of tunnel for this never-ending crisis. Inevitably, investors’ attention will focus on bank stocks like DBS, OCBC and UOB as they are the bellwether of the economy.

All eyes should be on the full-year financial result, which is expected to be released in the third week of February 2022. Will the result set OCBC share price on fire? Based on 9MFY2021 result, the net profit reached $3.885 billion while the net profit amounted to $1.224 billion in 3QFY2021. Looking at the trend of the past three quarters’ result, there is a strong possibility that 4QFY2021 may hit at least $1.2 billion of profit. If so, then full-year net profit for OCBC could smash a record $5 billion!

The previous record net profit for OCBC was in FY2019 ($4.87 billion). Unfortunately, that result was released in February 2020, which was right smack in the initial onset of the pandemic. The ensuing chaos in the global markets caused OCBC share price to plummet to a low of $8.40 on 20 March 2020.

Before the current crisis, the first time that OCBC Bank’s reported a net profit surpassing the $4 billion mark was for full-year 2017. Consequently, OCBC share price turbocharged to hit a record high of $13.70 in April 2018. If history is to repeat itself, there is a strong possibility that OCBC share price could be charging its way to $14 in the coming months.

Interestingly, OCBC Bank has ceased its relentless daily shares buybacks on 17 December 2021. Since August 2021, the bank had aggressively bought back its shares from the market. As at 17 December, the shares bought back amounted to 27,680,100. The shares buyback did not lead to an increase in OCBC share price. Instead, OCBC share price fell from $12.50 in August 2021 to a low of $11 on 30 November 2021.

Obviously, the market did not react well to OCBC’s capital management. Investors ultimately prefer the return to be in the form of dividend increase. After all, the Monetary Authority of Singapore (MAS) had lifted the cap on banks’ dividends on 28 July 2021. If the strategy is to enhance the ROE, then the straightforward approach should be improving the net income from Great Eastern Holdings and banking business.

For example, the ROE powered to 12.4% in Q1FY2021 when net income from insurance and banking businesses amounted to $373 million and $1.128 billion respectively. By Q3FY2021, ROE plummeted to 9.5% following net income from insurance and banking businesses amounted to $176 million and $1.05 billion respectively. On this basis, I doubt the share buybacks will make significant impact to the ROE.

OCBC share price to rocket with Great Eastern Holdings exit?

OCBC share price (SGX: )39) went AWOL

OCBC share price (SGX: )39) to rocket to Mars!

OCBC share price in Ring of Fire

Note that this is an opinion article and not meant to be a financial advice. Please do your due diligence or engage financial advisors before investing in the stock market. I am vested in this counter, so my views on OCBC share price may be biased.

OCBC share price to ride on interest rate hikes

Apart from the record FY2021 full-year financial result, 2022 could be a watershed year for OCBC share price. This is the year in which US Federal Reserves is expected to tighten the monetary policy. Another unfolding event that could shake OCBC share price is the start of the operations of the digital banks, which some investors fear could lead to a price war for bank products like mortgage loans. I will touch on the former first.

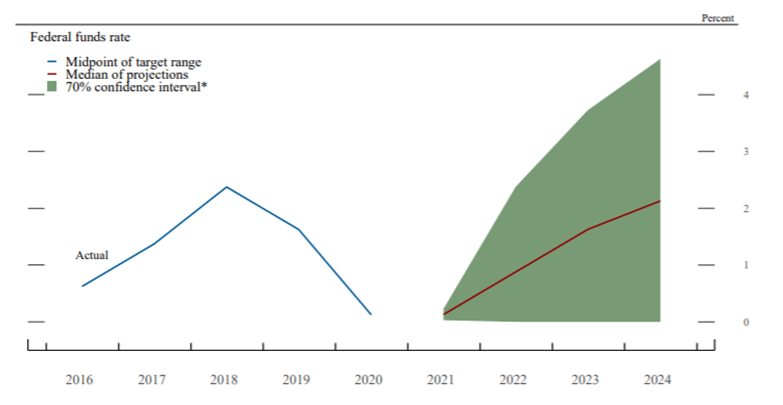

The Fed announced on 15 December 2021 that it would reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities. More importantly, the Fed is projecting that the federal funds rate could soar to 0.875% by end-2022 vis-à-vis the current 0.125%.

Source: US Federal Reserve Press Release (15 Dec 2021)

The spike in the federal funds rate will be a formidable tailwind for OCBC share price as the net interest income should increase accordingly. Assuming that net income for OCBC increases to [This is a premium article. The rest of the content is blocked and can be accessible by SG Wealth Builder Members only. To read the full content, please sign up as member.]

For members of SG Wealth Builder logging in from Apple or Mac devices, please access through this link. This allows for one-time log in only (instead of having to key in user-id and password twice).

Congratulations on your first step to becoming part of SG Wealth Builder community!

You may sign up for the monthly subscription for only $19.99 per month! You can choose to cancel the subscription at any point of time without penalty.

This plan is ideal for readers who wish to try out SG Wealth Builder Membership for a limited time. Thereafter, you may choose to upgrade to Lifetime Membership for a one-off payment.

The full benefits and privileges of SG Wealth Builder Membership:

- Access to the latest premium articles of SG Wealth Builder

- Email notifications of latest blog articles

- Request for coverage on stocks, insurance and other personal financial topics

- Comment in articles

Note: After payment is made, you will be prompted with registration form to create your user-id and personal password.