SG Wealth Builder

Make money. Build Wealth. Preserve Wealth

Month: December 2014

How to start your investment journey

Hi SG Wealth Builder,

BullionStar explained the difference between spot price and price premium

Below is an article from BullionStar, a bullion dealer based in Singapore where you can buy and store gold and silver at competitive prices. BullionStar was established in 2012 after Singapore government exempted investment grade precious metals from the goods and services tax (GST). Just like BullionStar, one of the goals of SG Wealth Builder is to educate Singaporeans on the merits of owning gold and silver bullion as a means of wealth preservation.

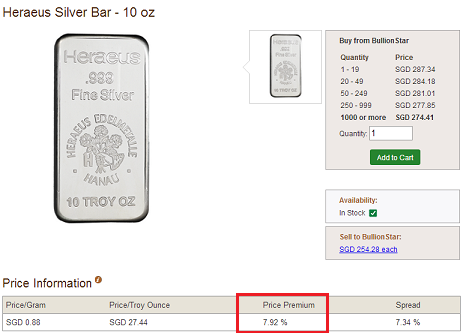

Precious metals and bullion products in physical form often have a higher price than the spot-price. The spot-price is the price for which someone can buy certificates or futures on the commodity exchange. It is however mathematically impossible, based on the paper market volume traded, for these so called paper metal products to be fully backed by physical precious metals.

Premium for Precious Metals

There are two components in the price premium for physical gold and silver.

How to invest in gold in Singapore

Basically, with effect from 1 Oct 2012, the importation and supply of IPM in Singapore are exempt from GST. The supply of IPM which is exported continues to be zero-rated. However, only precious metals in the form of a bar, ingot, wafer and coin which meet certain criteria can qualify as IPM.

To provide certainty, precious metal coins that qualify as IPM are prescribed in the GST Act. Precious metals which do not meet the criteria cannot qualify as IPM and the supply of non-IPM continues to be taxable. Examples of non-IPM are jewellery, scrap precious metals, numismatic coins and precious metals which are refined by refiners who are not on the “Good Delivery” list of the London Bullion Market Association or the London Platinum and Palladium Market.

Ruthless paycut

Since last year, there were lingering rumors that HR was hatching some plans to adjust our variable specialist allowances but we thought that the most drastic move that they would resort would be to incorporate the variable component into our basic pay. We never expect in our wildest dream that they would remove all our allowances. For many of us, the amount is a huge amount and make up at least 30% of our pay. So obviously we were very unhappy. The only consolation news was that the organization would remove the allowances in three years phases, so that affected staff would have time to adjust their personal finances.

This variable adjustable component was indicated in our salary contracts but the HR director insisted that the term “variable” means that the amount can be zero as well, subjected to individual performance and market condition. When he made that kind of statement, all my trust in the organization immediately flushed down the drain.

Achieving financial freedom in Singapore

Sorry to message you out of the blue (you may consider to publish my email but kindly oblique my name and email). I am 37 as of this year and I am a civil servant (which means I cannot do part time jobs or start a business) who have difficulty achieving financial stability.

The only good thing now is that I am not in debt (finally), apart from the $10,000 medical bills incurred recently (I have a exclusion for heart) which I am paying $300 per month interest free.

I tried reading all your posts from day 1 and more or less understand your objectives and purpose of the blog.

I am a person whom is very keen on being financially free in time to come and hope I can do it via investment. (one of the ways if i choose not to leave this current employment).

However, being an engineering student from polytechnic, I find it hard to kick-start my investment journey and often feel lost. Are you able to recommend me some books or what kind of topic I can look for before I can understand how this whole investment thing come about and how can I start doing it as time is definitely not on my side as I am approaching 40?