Rising US Dollar and Its Impact on Gold

Gold is often denominated and traded in US dollars, so a weak dollar will cause gold to be less expensive to buy. In addition, when US dollars devalue, investors will seek an alternative safe haven, such as gold, to store value. Loosely speaking, gold’s value is often correlated to the strength of the dollar. However, with the introduction of quantitative easing by the US government since 2008, I have always been puzzled that global inflation has not shot through the roof and purchasing power of the US dollar has not been diminished a single bit. In BullionStar’s website, I found my answer.

BullionStar explained that 80% of the global trade is still conducted in US dollars as businessmen still trust the stability of US government. In my opinion, a lot of credit must go to President Obama, who took over from his predecessor, George Bush, during the Great Financial Recession in 2009. Under Obama’s leadership, he helped to steer United States out of economic recession and in 2015, his hard work finally paid off. United States’ economy is finally showing sign of recovery and unemployment rate decreases substantially since last year. As a result. the value of US dollar rise for the past few months.

Bullionstar also pointed out that most commodities, such as oil and gold, are priced in US dollars. Thus, the recent drop in oil prices helped to boost US dollar value because of the increased purchasing power of dollar to buy oil. Inadvertently, because of the strengthening of the dollar, gold price is forced to retreat.

The last important point raised by BullionStar is that the US dollar has been long regarded as the world defacto reserve currency and many central banks hold US dollar as their foreign reserve holdings. US dollar’s supremacy has been challenged for many years and many doubters have speculated its downfall. However, till today, US dollar has remained dominant and it is estimated that 60% of the global foreign currency reserves are held in US dollar. Henceforth, it is unlikely that in the near future, central banks will dump US dollar and revert to the gold standard.

In Singapore, you can buy gold and silver bullion online from BullionStar, a bullion dealer based in Singapore which exempted investment grade precious metals from the goods and services tax (GST). You can choose to self collect your bullion at BullionStar’s store, or opt for home delivery. Alternatively, you can choose to store your bullion at BullionStar’s vault storage.

There are 4 easy steps to buy your precious metals through BullionStar as described below. A more detailed step by step guide is available here.

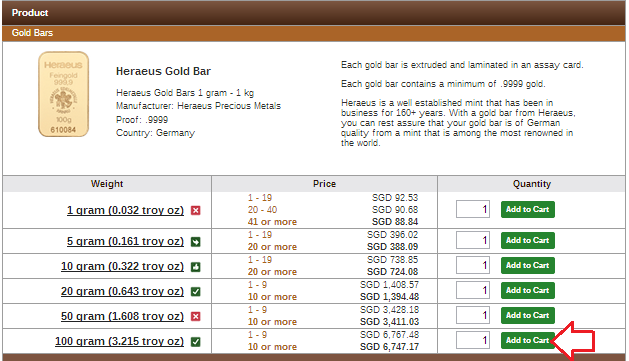

Step 1: Place the desired products in your shopping cart. There is no minimum or maximum amount when purchasing from BullionStar.

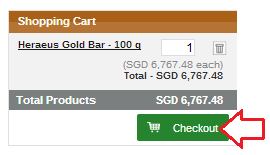

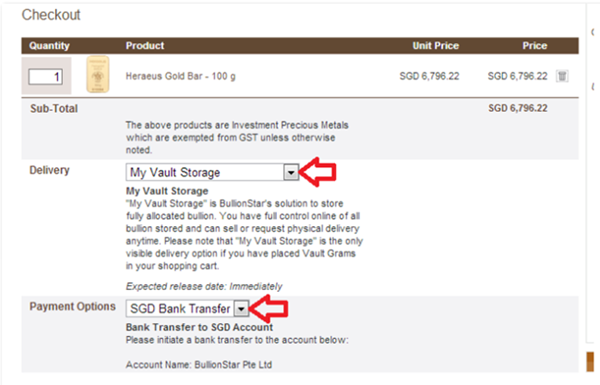

Step 2: Click “Checkout” in the Shopping Cart to go to the checkout. Select delivery and payment method in the checkout.

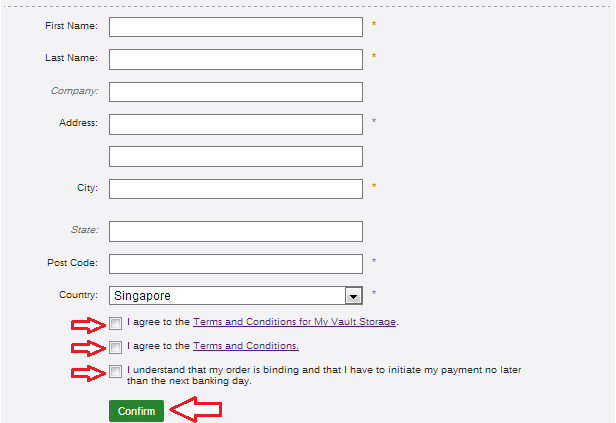

Step 3: Confirm and pay for your order.

Step 4: Depending on the delivery method you have chosen, your products will be:

– Available for pick-up at 45 New Bridge Road, Singapore 059398. No appointment for pick-up is necessary.

– Shipped to your delivery address; or

– Stored for you in My Vault Storage® in our vault at 45 New Bridge Road for you to inspect, sell or physically withdraw anytime.

You can follow the order process from purchase to delivery. We will update you by sending e-mail order status updates. You will receive e-mails for order confirmation; payment confirmation; and confirmation of delivery, availability for pickup, or storage.

Magically yours,

SG Wealth Builder