Sembcorp Marine share price collapsed

LIFETIME MEMBERSHIP What a mayhem for Sembcorp Marine share price! On 24 June, both Sembcorp Marine and Keppel Corp requested trading halts for their counters. The trading halts were in preparation for the release of the epic announcements in relation to the bombshell $1.5 billion rights issue and commencement of merger talks between Sembcorp Marine and Keppel Offshore & Marine (KOM).

For Sembcorp Marine share price, it is a case of lightning strikes twice. The previous rights issue of $2.1 billion took place just in September 2020. And now, within a span of less than a year, Sembcorp Marine has come back to ask for more money from shareholders. To rub salt into injury, the latest cash call amounted to a staggering $1.5 billion, representing 63% of the current market capitalization. Against this backdrop, Sembcorp Marine share price plunged by as much as 28% after trading halt was lifted.

For sure, the twin announcements raised more questions than answers for investors. A few SG Wealth Builders had written in to request for my insights. Understandably, confidence was shaken for Sembcorp Marine share price. The management shot itself in the foot by announcing the massive rights issue together with the merger talks with KOM.

Make no mistake, the official reason given by Sembcorp Marine for the $1.5 billion rights issue was to address working capital depletion, debt servicing and liquidity issue. This is a clear indication that the upcoming 1HFY2021 financial result could be a disaster, so investors must brace themselves for another wave of correction for Sembcorp Marine share price in July. An important thing to note is the rights issue is not meant to fund the potential merger with KOM.

Previously, I have indicated that a merger with KOM will be the perfect catalyst for Sembcorp Marine share price. Till now, I still maintain this position. What I did not anticipate is the outrageous $1.5 billion cash call, which is really not meant to fund the acquisition of KOM. If Sembcorp Marine announced only the merger talks with KOM, I am convinced that the market will react positively and send Sembcorp Marine share price to high heavens. But this is not the case here.

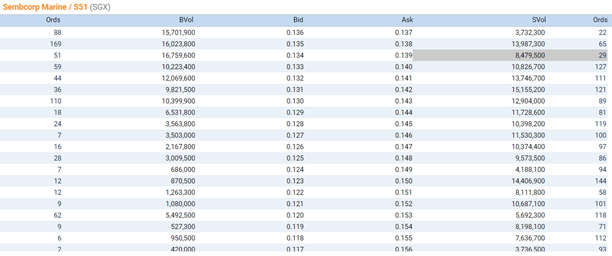

A check on SGX’s Market Depth revealed that volatility remains the name of the game for Sembcorp Marine share price. On 25 June, there were 169 buy queue orders amounting to a whopping 16 million shares at $0.135. This represents the support level for Sembcorp Marine share price. Indeed, the market reactions had been massively adverse for Sembcorp Marine share price. On the basis of the current form, Sembcorp Marine share price is expected to continue its correction trend next week.

Sembcorp Marine share price to sink or swim?

Sembcorp Marine share price to smash past $0.40?

With the latest turn of events, investor will have plenty of sleepless nights but it is certainly not the end of the road for Sembcorp Marine share price. My thesis for this counter remains the same: investors should go for small wins from the volatility of Sembcorp Marine share price. However, due to the cyclical nature of the oil and gas industry, I would not adopt a long term buy-and-hold strategy for this counter. The opportunity cost is just too huge as the business turnaround is uncertain.

Note that this is an opinion article and not meant to be a financial advice. Please do your due diligence or engage financial advisors before investing in the stock market. I am not vested in Sembcorp Marine at the moment. Whether Sembcorp Marine share price will surge or collapse has no impact on me. Thus, this article is not meant to induce readers to make any form of investment decisions.

Sembcorp Marine share price ambushed by cash call

The $1.5 billion rights issue is subjected to approval in the extraordinary general meeting (EGM), which is expected to be held in August 2021. Thus, it is not a done deal yet. In the event that the rights issue is approved, the theoretical ex rights price will be $0.124. As Sembcorp Marine share is currently being traded at around $0.140, the counter should continue its downward spiral in the coming weeks. In view of the chaos, I do think that it is really too premature to enter and accumulate.

Given the sudden cash call, it appears to me that Sembcorp Marine’s liquidity had been severely impacted by COVID-19. The first sign of trouble can be gleaned from the net cash used in operating activities. For Sembcorp Marine, there was cash outflow from operating activities amounting to a stunning $750 million for FY2020. As of 31 December 2020, the Group only has cash holding of $772 million in the bank. So, if shareholders rejected the rights issue in the August EGM, [This is a premium article. The rest of the content is blocked and can be accessible by SG Wealth Builder Members only. To read the full content, please sign up as member.]

LIFETIME MEMBERSHIPCongratulations on your first step to becoming part of SG Wealth Builder community! For a one-off payment of $200, you can get full access to all the articles and enjoy the benefits of SG Wealth Builder Membership.

The full benefits and privileges of SG Wealth Builder Membership:

- Access to the latest premium articles of SG Wealth Builder

- Email notifications of latest blog articles

- Request for coverage on stocks, insurance and other personal financial topics

- Comment in articles

Note: After payment is made, you will be prompted with registration form to create your user-id and personal password.