BullionStar explained the difference between spot price and price premium

Below is an article from BullionStar, a bullion dealer based in Singapore where you can buy and store gold and silver at competitive prices. BullionStar was established in 2012 after Singapore government exempted investment grade precious metals from the goods and services tax (GST). Just like BullionStar, one of the goals of SG Wealth Builder is to educate Singaporeans on the merits of owning gold and silver bullion as a means of wealth preservation.

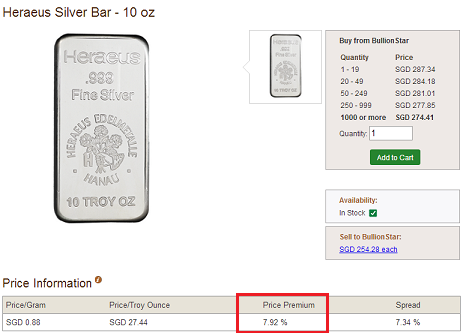

Precious metals and bullion products in physical form often have a higher price than the spot-price. The spot-price is the price for which someone can buy certificates or futures on the commodity exchange. It is however mathematically impossible, based on the paper market volume traded, for these so called paper metal products to be fully backed by physical precious metals.

Premium for Precious Metals

There are two components in the price premium for physical gold and silver. The first and most natural part is accounted for in the melt and minting cost. This part of the premium is called the natural premium. The second component is a market premium that arises when the supply and demand in the paper market for certificates and futures doesn’t correspond with the physical market.

Natural Premium

First, take a look at the production cost for gold and silver in bullion form. BullionStar explained that gold and silver in bullion form is often minted into 1 oz coins or small bars ranging from 1 oz to 10 oz. It is an advanced process to melt, mint and certify bullion products with high quality and precision.

Everything from design work to manually engraving stamps has to be calculated in the cost, corresponding to the natural premium. It is therefore normal that a 1 oz bullion coin costs more than 1 oz of the actual metal. Since the spot price for gold is multiple times higher than that of silver, it is also normal that the premium for a 1 oz silver coin amounts to a larger proportion of the price percentage-wise compared to a 1 oz gold coin. The natural premium doesn’t change much over time, and matches the cost of the minting process.

The other part of the price premium is the market premium. This part of the premium reflects the difference between the price of paper metal on the spot market and the price of physical metal on the real physical market. The market premium fluctuates depending on different factors such as:

– Lack of production capacity for smaller coins/bars; and – Limited mintage of certain products.

In a functioning market, there would be no such thing as a market premium for physical precious metals. The expression in itself reveals that the “market” isn’t controlled by normal market forces. The commodity exchanges were originally meant to serve producers so they could hedge by selling future metals for the purpose of limiting uncertainty when raising money for production. The commodity markets today are controlled by large banks which trading volumes are much larger than there is backing by physical precious metals.

The result is that more and more fiat-money is competing for the same limited amount of precious metals. When enough people request physical delivery of paper metal products, it will be revealed that there is not enough physical metal to back up all the paper promises.

Paper metal is created out of thin air and bought by money likewise created out of thin air. Real physical precious metals, on the contrary, can not be created out of thin air but have an inherent value that will persist over time.

Magically yours,

SG Wealth Builder